Top alternatives to traditional insurance in St. Louis, MO, include options like self-insurance, health sharing ministries, risk pooling groups, & usage-based insurance. Self-insurance allows individuals to set aside funds for emergencies, while health sharing ministries provide affordable healthcare through shared costs among members. Risk pooling groups offer collective support for specific risks, reducing individual financial burdens. And another thing, usage-based insurance tailors premiums to actual usage, making it a cost-effective choice for lower-risk drivers. These alternatives present flexible, budget-friendly solutions for comprehensive coverage without the high costs of conventional insurance.

Top Alternatives to Insurance in St. Louis, MO: Affordable Options Revealed. Discover the Top Alternatives to Insurance in St. Louis, MO! Explore affordable options that fit your needs without breaking the bank.

Understanding Alternatives: What Can Replace Insurance?

Insurance often presents challenges, primarily due to expenses associated with premiums, coverage, & limitations. Many individuals in St. Louis, MO, increasingly seek ways around conventional insurance models while still ensuring financial protections. Exploring affordable alternatives may unveil several viable options tailored for varied needs without breaking budgets. In navigating through local financial solutions, decision-making processes become less daunting, & effective protective strategies materialize. Therefore, knowing potential substitutes allows for confident steps toward financial security.

Health Savings Accounts (HSAs)

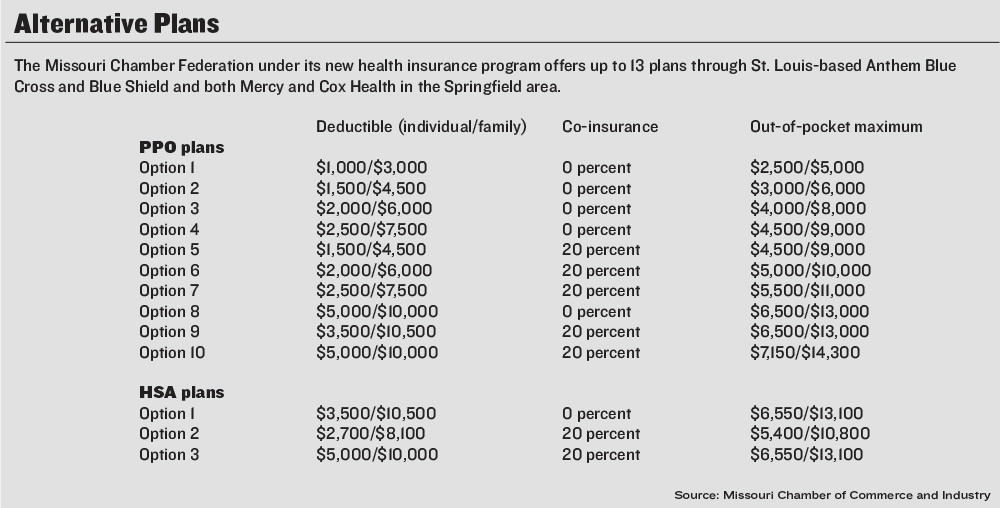

Health Savings Accounts offer significant flexibility & affordability regarding medical expenses. Contributors enjoy tax-deductible contributions, tax-free growth, & tax-free emerging withdrawals when used for eligible medical expenses. This unique financial tool allows for building savings while managing healthcare costs effectively. Those who choose High Deductible Health Plans (HDHPs) may find HSAs particularly advantageous, as they combine health coverage with potential savings growth. Contributing regularly can prepare one for unexpected medical situations, easing future financial burdens. Investing in HSAs promotes proactive financial management & empowers individuals to take control of healthcare expenses.

Self-directed HSAs grant access to various investment options. The ability to diversify investments within HSAs can lead to substantial growth over time, proving valuable for those who plan accordingly. For St. Louis residents, contributing early & maximizing the use of HSAs could foster long-term health security. Resources are readily available at local banks & credit unions to assist in setting up personalized HSAs tailored for individual needs.

In my experience, utilizing an HSA has allowed me a degree of control over my healthcare costs. By consistently contributing, I’ve managed to build a safety net, enabling me to address medical needs without excessive worry about out-of-pocket expenses. This financial freedom became relieving during unforeseen emergencies.

HSAs: Key Benefits

- Tax-deductible contributions

- Tax-free withdrawals for eligible expenses

- Investment growth potential

- Roll-over feature for unused funds

- Access to various banking institutions

Medical Cost Sharing Plans

Medical cost sharing programs represent a community-focused approach whereby groups of individuals join together contributing monthly amounts. These pooled contributions provide assistance during medical emergencies. Unlike traditional insurance, members share costs among themselves, alleviating financial strain during high medical bills. Many local communities in St. Louis have adopted these plans, fostering a sense of camaraderie & support.

Participation in a medical cost-sharing program typically requires fulfilling certain eligibility criteria or membership rules. Prioritizing transparency & accountability, each member expects others to contribute fairly & responsibly. Numerous testimonials from participants suggest that such arrangements have fostered stronger community ties while offering essential financial assistance. By working together, members can afford healthcare costs without relying solely on insurance.

Choosing a medical cost-sharing plan reflects values emphasizing community support, mutual aid, & shared responsibility. As costs rise, these programs might emerge as formidable contenders against conventional insurance options, particularly for those seeking connections with like-minded individuals.

Advantages of Medical Cost Sharing Plans

- Typically lower monthly costs

- Flexible membership requirements

- Community-driven support

- Transparency in cost allocations

- Variety of plans available

Direct Primary Care Models

Direct Primary Care (DPC) emerges as an innovative model providing personalized medical care without engaging insurance intermediaries. Patients pay a monthly fee directly to their healthcare provider, securing access to a wide range of services. This arrangement fosters a strong patient-physician relationship. Accessible care eliminates many limitations associated with traditional insurance, prioritizing quality & attentiveness.

Through DPC, patients often enjoy longer appointments, reduced waiting times, & comprehensive health assessments. This model allows physicians to prioritize quality of care instead of upholding insurance protocols. DPC practices can typically provide transparent pricing structures upfront, eliminating uncertainties tied to insurance plans. St. Louis has witnessed a rising trend in DPC offerings as more individuals recognize benefits associated with this model.

In addition, patients can tailor their care according to personal needs, fostering a more satisfying healthcare experience. As DPC enables personalized, responsive care, many individuals find great value in replacing traditional insurance with this alternative. Navigating healthcare becomes simplified, allowing easier access to necessary services & wellness-focused approaches.

Benefits of Direct Primary Care

- Enhanced access to healthcare providers

- Prioritization of patient relationships

- Transparent & predictable costs

- Customized care plans to individual needs

- Minimal bureaucratic interference

Peer-to-Peer Lending Platforms

Peer-to-peer lending represents an innovative financing solution, allowing individuals facing unexpected expenses to connect directly with potential lenders. Borrowers can apply for loans to handle medical bills or other urgent costs, showcasing their risk factors & personal stories to entice lenders. Many residents in St. Louis have increasingly looked towards peer-to-peer platforms as viable alternatives for funding significant financial needs.

Such platforms typically allow for competitive interest rates & flexible repayment terms, making them attractive options compared to traditional loans. Personal stories resonate with potential lenders, establishing trust & transparency. As more individuals become aware of peer-to-peer lending advantages, this alternative financing model continues gaining popularity.

Community-focused initiatives can foster healthy relationships between borrowers & lenders, enhancing local economies. Peer-to-peer lending platforms also obsessively emphasize ethical practices, contributing to a stronger sense of shared responsibility. With the growing demand for flexible financial solutions, many may find solace in this alternative financing route.

Peer-to-Peer Lending Highlights

- Competitive interest rates

- Flexible repayment options

- Potential for quick funding

- Promotes ethical lending practices

- Enhances community connections

Utilizing Crowdfunding Platforms

Crowdfunding has exploded in popularity, enabling individuals facing significant medical bills or emergencies to raise funds through collective community support. Online platforms allow people to present their needs, share stories, & seek donations from family, friends, & strangers alike. St. Louis residents have successfully utilized crowdfunding methods to address pressing financial needs, showcasing powerful community resilience.

Many crowdfunding websites provide tools for effective fundraising campaigns, including tips for storytelling, marketing strategies, & community engagement. Effective communication fosters connection, compelling others to help alleviate financial burdens when emergencies arise. While crowdfunding does not guarantee full coverage, it enriches lives through shared support & compassion; many have directly benefited from generous contributions.

Creating a successful crowdfunding campaign requires diligence, transparency, & effective outreach techniques. Engaging networks & utilizing social media can amplify campaigns’ reach & efficacy. Through these efforts, fundraising initiatives can flourish, offering financial relief & empowering individuals through community-focused support.

Standout Crowdfunding Benefits

- Direct community support

- Stories connect with potential donors

- Empowers individuals in need

- Encourages cooperative engagement

- Access to various online platforms

Barter Systems & Local Exchange Trading

Bartering underscores an age-old practice that allows individuals & businesses to exchange goods & services without involving cash. Creating local networks within St. Louis can rejuvenate communities, enabling residents to support one another while leveraging unique skills & resources. Successful bartering ultimately enhances financial flexibility, particularly during challenging times when cash flow becomes strained.

Engaging in barter systems requires creativity, communication, & resourcefulness. Identifying skills & services offers unique reciprocal opportunities for collaboration. Not only does bartering promote community involvement, but it also fosters trust & cooperation. Numerous online platforms facilitate these exchanges, establishing frameworks for community interactions while expanding available offerings.

Overall, embracing bartering as an alternative fosters a sense of unity within neighborhoods, improving local economies while decreasing reliance on cash transactions. In St. Louis, various bartering groups & initiatives have emerged, integrating this timeless practice into modern life.

Bartering Advantages

- Reduces reliance on cash

- Promotes local community support

- Encourages creativity in exchanges

- Access to diverse goods & services

- Strengthens local economy connections

Community Support Programs & Resources

Many community support programs in St. Louis aim to assist individuals struggling financially. Local non-profits & organizations often offer programs addressing various needs, including healthcare, housing stability, & job training. Through collaborations with community partners, these programs can facilitate significant benefits to enhance lives while providing essential assistance.

Engaging with community resources not only fosters support networks but also promotes resilience among members. Individuals can connect with available programs tailored to meet unique needs, ultimately enhancing financial wellbeing. St. Louis residents should explore resources available through local municipalities, schools, & non-profits designed to aid those facing difficulties.

Proactively seeking assistance & building connections can alleviate pressures of financial challenges. And don’t forget, community-driven solutions offer hope & support for individuals navigating life’s complexities, encouraging collective growth & resilience.

Community Resource Benefits

- Access to diverse assistance programs

- Opportunities for networking

- Encouragement from community initiatives

- Personalized support tailored to needs

- Empowers individuals through resource access

Tables of Alternatives to Insurance

| Alternative Option | Monthly Cost | Access Type |

|---|---|---|

| Health Savings Account | Variable | Direct access |

| Medical Cost Sharing | Lower than insurance | Community access |

| Direct Primary Care | Monthly subscription | Direct provider access |

| Crowdfunding Platform | Typical Fee | Funding Potential |

|---|---|---|

| GoFundMe | Varies | Variables based on campaign |

| Kickstarter | Standard fee | Project-based funding |

| Indiegogo | Campaign-based | Promoting innovative ideas |

“Exploring alternatives opens doors; individuals can secure financial peace without traditional barriers.”

| Barter Service | Common Benefits | Participation Method |

|---|---|---|

| Local Barter Group | Skill exchange | In-person interaction |

| Skill Swaps | Resource sharing | Community events |

| Online Barter Platforms | Wider reach | Digital interactions |

Discover the Top Alternatives to Insurance in St. Louis, MO! Explore affordable options that fit your needs without breaking the bank.

Conclusion

In St. Louis, MO, finding affordable options doesn’t have to be difficult. You now know about the top alternatives to insurance that can help you stay protected without breaking the bank. From health care sharing plans to community-based resources, there are many choices tailored to fit different needs. Remember, taking the time to explore each of these affordable options can lead to a solution that works best for you. So, whether you need coverage for health, auto, or home, consider these alternatives to make informed decisions & enjoy peace of mind.